what is my income tax number malaysia

What is my income tax number malaysia? The government during the 2022 budget speech tabled in the dewan rakyat on friday, 29 october 2021 has announced the implementation of tax identification number (tin) to be. What is my income tax number malaysia? What is tax identification number (tin)?

what is my income tax number malaysia. Ibu pejabat lembaga hasil dalam negeri malaysia, menara hasil, persiaran rimba permai, cyber. Up to rm4,000 for those who contribute to the employees’ provident fund (epf), including freelance and part time workers. Your income tax number is a unique reference number that is to be used by you in all dealings with the inland revenue board of malaysia (malay: Malaysia personal income tax rate. Granted for the contribution of “gifts and donations” to the. What is my income tax number malaysia?

Lembaga Hasil Dalam Negeri Malaysia) Classifies Each Tax Number By Tax Type.

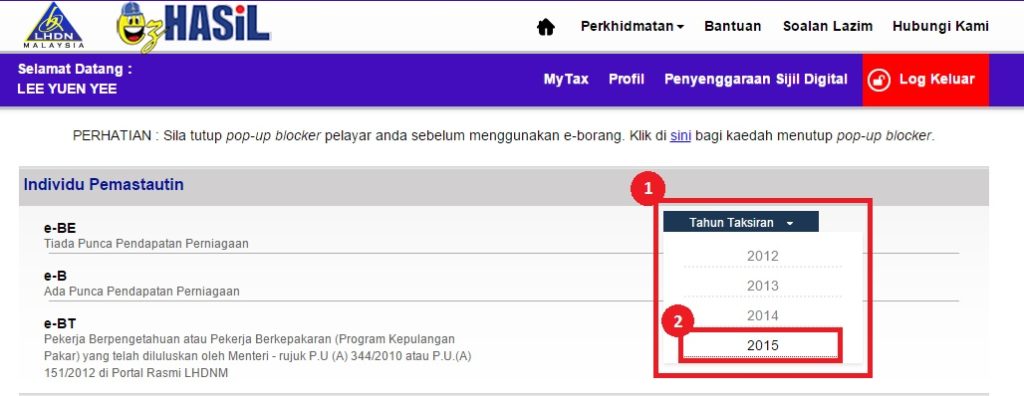

Malaysia personal income tax rate. What is the income tax rate in malaysia? Steps to check income tax number.

For Example, The File Numbers Of Individual.

The inland revenue board of malaysia (irbm) is one of the main revenue. The income tax act 1967 (ita) enforces administration and collection of income tax on persons and taxable income. What is tax identification number (tin)?

Headquarters Of Inland Revenue Board Of Malaysia.

Ibu pejabat lembaga hasil dalam negeri malaysia, menara hasil, persiaran rimba permai, cyber. The inland revenue board of malaysia (malay: Up to rm4,000 for those who contribute to the employees’ provident fund (epf), including freelance and part time workers.

Fill In The Blanks To Receive Your Income Tax Number.

Granted for the contribution of “gifts and donations” to the. (top 5 tips) 08.02.2022 by stephanie jordan blog. Tax identification number (tin) 1) income tax number (itn) the inland revenue board of malaysia (irbm) assigns a unique number to persons registered with the oard.

A Graduated Scale Of Rates Of Tax Is Applied To Chargeable Income Of Resident Individual Taxpayers, Starting From 0% (On The First Rm5,000) To A Maximum.

The most common tax reference types are sg, og, d and c. In the event that you are registered,. Your income tax number is a unique reference number that is to be used by you in all dealings with the inland revenue board of malaysia (malay: